Posts

The Truth About Medicare Set-Aside Solutions – How What You Don’t Know Could Hurt You

Medicare eligible. It seems that when a defendant hears these words, CMS automatically places a target on your client’s back and aims for the bullseye. We have seen this happen year in and year out. That is why we crafted the ability to provide attorneys with holistic Medicare Set-Aside solutions.

The label of being “medicare eligible” can lead to many un-truths. For example, defendants may claim that your client must create an MSA. Un-true. And this one: that defendants won’t be able to settle your case until they have proof that Centers for Medicare and Medicaid Services (CMS) has approved your client’s MSA. Un-true. Or, that you must obtain a CMS letter stating that an MSA is not required in your client’s case. Un-true, and not even possible. If any of this sounds familiar, it’s because defendants have been telling you un-truths about Medicare Set-Aside (MSA) arrangements for years.

The truth is that there is no legal requirement for MSAs at all in liability personal injury cases. CMS is not approving liability MSAs. Also, CMS will not provide a letter stating that an MSA is not required in a specific case. In fact, MSAs are entirely voluntary. A conclusion that arose again as a result of the Aranki vs. Burwell case. Yet, this outcome doesn’t mean that MSAs should be ignored. No. Far from it. That is why we have tirelessly sought to provide Medicare Set-Aside solutions that address these untruths to help your client make an informed decision. Part of making an informed decision is knowing the history of MSAs, and understanding why MSAs should not be ignored.

The History Behind Medicare Set-Aside Solutions

The Aranki vs. Burwell case evolved from a medical malpractice case that started in 2009 in Arizona. While a settlement had been reached, the defendants were still concerned about its finality due to the uncertainty of the MSA question. A lot was unknown about MSAs back then, and the defendants thought they would be liable without a court decision on its necessity. They demanded that the plaintiffs supply them with a letter from CMS stating whether or not the client was required to set up an MSA. With no immediate answer, the settlement was held up for three years. That is, until a federal judge issued a pronouncement.

The judge stated that no federal law or CMS regulation requires the creation of an MSA in a personal injury settlement. It gets better. This judge was also asked to rule on forcing CMS to issue a letter as to whether or not this client needs an MSA. The ultimate finding being that there’s no federal law that requires it [CMS to issue a letter], so the court doesn’t see any standing here to even comment. No MSA required meant case closed, and this decision has acted as the ruling going forward. Yet, recent events indicate that a change could be coming soon.

Recent Developments

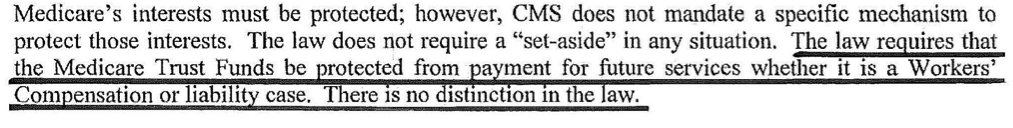

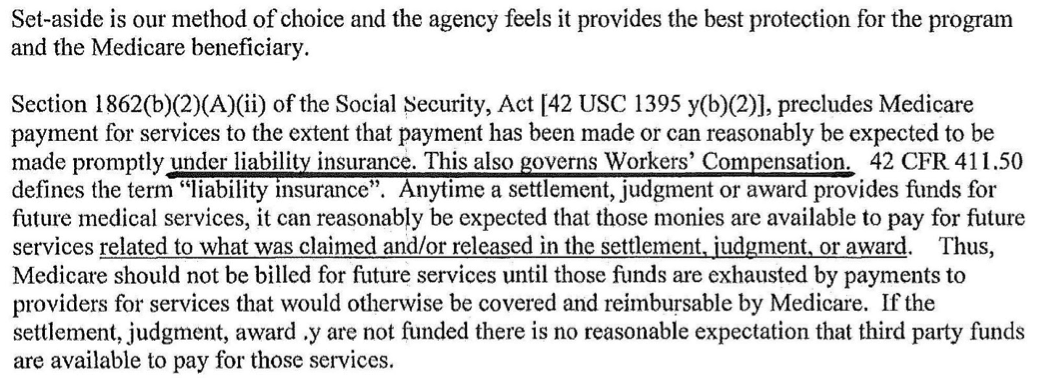

More critical insight is available in the 2011 Stalcup memo. A memo by Sally Stalcup, Regional Director of Region 6 for Medicare and CMS in Dallas. Her memo states that we must protect Medicare trust funds from payment for future service. Regardless of whether it’s Worker’s Comp. or liability. Surrounding language indicates that while CMS does not mandate a specific mechanism to protect those interests, and the law does not require a set-aside in any situation, that an MSA is the preferred method. Also of note is that any time plaintiffs can expect settlement funds to pay for future services, they can’t bill Medicare for future medical services until the exhaustion of these funds. Exact text is below:

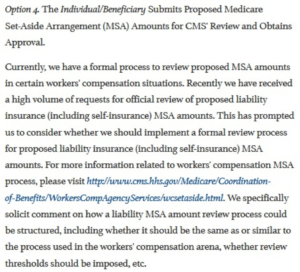

After this memo, a clamor for guidance followed. With that, came an advance notice of proposed rulemaking. Issued on June 15, 2012. This advance notice, addressing liability cases, includes seven different options. All of them for handling the Liability Medicare Set-Aside issue. Especially alarming is option number four, below. It requires submitting a proposed MSA to CMS for review and approval.

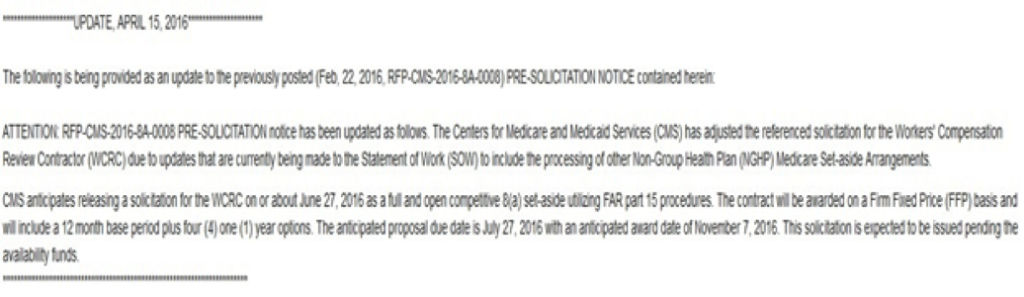

Fast forward two years later to October 8, 2014. CMS withdrew The Project for Public Guidance. This advance notice was part of that project. Yet, expectations that CMS will resubmit at some point in the future still loom large. Added to these is another concern. Earlier, CMS published an update to a pre-solicitation for a workers compensation review contractor. It states that a Statement of Work (SOW) update will include the processing of Non-Group Health Plan (NGHP) Medicare Set-Aside arrangements. The anticipated award date? November 7, 2016.

All of these are signs that the U.S. Government has pivoted. Also, that they are looking once again at Medicare Set-Aside arrangements in liability personal injury cases.

What Comes Next?

Meanwhile, it’s important to decide whether, and which, Medicare Set-Aside solution is right for your client. That depends on their unique facts and circumstances. Also, whether they are a do-it-yourself or a do-it-for-you type. The law requires that we protect Medicare Trust Funds from payment for future services. That is true whether it is a Worker’s Compensation or Liability case. There is no distinction in the law. But how exactly will your client comply with the law? The old pick a number out of the air? Or a professional MSA Allocation Study? Then, next question, self-administer, or professionally administered? If they go the do-it-yourself route, can you trust that they will follow through and put some amount of money from their settlement in some sort of account? And then what, just decide on their own which Medicare bills should be paid?

If and/or when Medicare comes around and questions how your client determined the amount of their account, demanding a detailed accounting of how they spent that money, how will your client answer? What if Medicare dislikes their answers, and decides to deny future benefits for a time? Will your client still be happy with the advice you gave them today? Whatever you do, don’t make these decisions alone. Take advantage of consultation services from The PLAINTIFF’S MSA AND LIEN SOLUTION.

Let Us Help

Order our 3 Ways to Avoid an LMSA Toolkit. Together, we can decide if one of these ways can work for you. And if your client can’t avoid an MSA and wants professional help? Then we’ll create a custom, strategically-minimized Medicare Set-Aside allocation. One brought down to the lowest possible, reasonable and defensible number. The end result? More settlement funds in your client’s pocket. Less potential for future liability for you.

The PLAINTIFF’S MSA AND LIEN SOLUTION is here for you. Please visit our website at plaintiffsmsa.com or call us with any questions at 888-672-7583.

For Plaintiff Lawyers Serious About Stopping Medicare Issues COLD

The Centers for Medicare & Medicaid Services (CMS) has updated the release date for its forthcoming regulation addressing future medical expenses under the Medicare Secondary Payer (MSP) Act.

In this video Jack shares what you need to know, and provides guidance about how you & your firm can prepare for the coming changes.

Struck by a Concrete Truck & MSA Reduced to ZERO – Another PMLS Victory for Claimant & Attorney

For Plaintiff Lawyers Serious About Stopping Medicare Issues COLD

This time, PMLS shares the story of an injury victim struck by a concrete truck. More importantly, he also shares how PMLS was able to reduce this victim’s MSA to zero.

If you want more information about how THE PLAINTIFF’S MSA & LIEN SOLUTION can help you CONQUER your Medicare and lien problems and possibly make them DISAPPEAR or get significantly reduced, go to our PMLS website https://plaintiffsmsa.com, or call us at 888-MSA-PLTF (888-672-7583).

P.S. View our “Attorneys Sued Over Medicare Issues” resource at: https://plaintiffsmsa.com/attorneys-sued-over-medicare-issues/

From Jack’s Desk: PMLS Video #44

Medicare & Dental Work – Teeth Are a Luxury

Jack Meligan had a plaintiff attorney reach out to him asking for some insight about helping an injury victim who needed some dental work done.

2020’s Medicare open enrollment deadline is December 7th, 2019. In this video, Jack shares Medicare’s position on dental work. He also gives you a work-around, should you ever find yourself working with an injury victim who needs dental work.

Medicare is Pivoting and Change is Coming

Make sure that you and your firm are ready.

Avoiding MSAs – At PMLS we have created tools and resources to help plaintiff attorneys avoid MSAs:

THE INSIDER’S GUIDE TO AVOIDING MSAs – If you would like to download our free resource – “THE INSIDER’S GUIDE TO AVOIDING MSAs”– see this link: http://www.avoidingmsas.com

THE 3 WAYS TO AVOID AN LMSA TOOLKIT – If you would like to purchase “THE 3 WAYS TO AVOID AN LMSA TOOLKIT,” see this link: https://plaintiffsmsa.com/order-the-three-ways-to-avoid-an-lmsa-toolkit/?page=toolkit

If you are ready to have the THE PLAINTIFF’S MSA & LIEN SOLUTION help you CONQUER your and possibly make them DISAPPEAR or get significantly reduced, then go to our website plaintiffsmsa.com. Or, call us at 888-MSA-PLTF (888-672-7583) for a no charge, no obligation initial consult.

Also, check out our “Attorneys Sued Over Medicare Issues” resource: www.AttorneysSuedOverMedicareIssues.com

P.S. “I have known and worked with Meligan and his firm for almost 20 years. They know this stuff. These folks are easy to work with, and you are likely to learn something that makes your life easier.”

— Rick H. Friedman, Friedman | Rubin, Seattle, WA

From Jack’s Desk: PMLS Video #45 The Nasty Surprise at Mediation – When the Defendant Requires a Last Minute MSA

Jack Meligan recently had a number of attorneys tell him about the nasty surprise that defendants have been springing on them. Defendants have been requiring Liability MSAs — last minute — at the mediation table.

In this video, Jack shares what you can do to head this off and help your clients avoid unnecessary MSAs.

Medicare is Pivoting and Change is Coming

Make sure that you and your firm are ready.

Avoiding MSAs – At PMLS we have created tools and resources to help plaintiff attorneys avoid MSAs.

THE INSIDER’S GUIDE TO AVOIDING MSAs – To download our free resource – “THE INSIDER’S GUIDE TO AVOIDING MSAs”– see this link: http://www.avoidingmsas.com

THE 3 WAYS TO AVOID AN LMSA TOOLKIT – To purchase “THE 3 WAYS TO AVOID AN LMSA TOOLKIT,” see this link: https://plaintiffsmsa.com/order-the-three-ways-to-avoid-an-lmsa-toolkit/?page=toolkit

If you are ready to have the THE PLAINTIFF’S MSA & LIEN SOLUTION help you CONQUER your and possibly make them DISAPPEAR or get significantly reduced, then go to our website plaintiffsmsa.com. Or, call us at 888-MSA-PLTF (888-672-7583) for a no charge, no-obligation initial consult.

Also, check out our “Attorneys Sued Over Medicare Issues” resource: www.AttorneysSuedOverMedicareIssues.com.

P.S. “We used your MSA strategy during my client’s mediation. It resulted in defendants adding $1.2 million to their previous offer, which settled the case. Your post settlement MSA strategy increased the net to our client by over $800,000. I am very happy with this $2,000,000 improvement to our case settlement.”

— Joe Piucci, Esq., Piucci Law, Portland, OR

Making MSAs Disappear

At PMLS our battle cry is ZERO IS THE HERO! Our focus is on making MSAs disappear.

We have three ways to avoid an MSA. When we can’t make an MSA disappear entirely, we work to see that it is MASSIVELY REDUCED. Specifically, to the lowest rock-bottom amount that is reasonable and defensible.

Here are just a couple stories about MSAs we have battled for our clients:

Making 93% of an MSA Disappear!

When “Free” Costs Almost a Quarter Million Dollars…

If you are ready to have us CONQUER your Medicare and lien problems and make them DISAPPEAR – call us at 888-MSA-PLTF or 888-672-7583.

From Jack’s Desk #39: A Love Letter from

Medicare Advantage Plans

In this video, Jack Meligan shows and tells you about an actual letter from Humana that was sent to an MSA Administrator.

This letter explicitly displays Humana’s request for reimbursement for Medicare conditional payments they made on behalf of the injury victim.

Jack also discusses the Supreme Court decision that gives Medicare Advantage Plans like Humana the right to receive reimbursement.

Medicare is Pivoting and Change is Coming

Make sure that you and your firm are ready.

In the video below, Jack Meligan shows and tells you about an actual Medicare Summary Notice sent to a Medicare beneficiary that outlines Medicare Part B services that were denied. Because, as the letter says, “you may have funds set aside from your settlement …”

If you want more information about how THE PLAINTIFF’S MSA & LIEN SOLUTION can help you CONQUER your and possibly make them DISAPPEAR or get significantly reduced, then go to our PMLS website plaintiffsmsa.com. Or, call us at 888-MSA-PLTF (888-672-7583).

Also, check out our “Attorneys Sued Over Medicare Issues” resource here: www.AttorneysSuedOverMedicareIssues.com.

Three Ways to Avoid an LMSA (Liability Medicare Set-Aside)

Once again, we have innovated! Before, we had two ways that you could use to help your clients avoid an LMSA. Now, we have a third option for you!

888-MSA-PLTF (888-672-7583)

888-MSA-PLTF (888-672-7583)