Posts

I hope this year has been going well for you so far, or at least, better than it has been for Simon & Simon, P.C. Simon & Simon, P.C. is the fourth firm to take a hit from Medicare, and they won’t be the last.

After getting nailed for failing to resolve their clients’ Medicare Conditional Payments, Simon & Simon, P.C. settled with the DOJ for $6,604.59 and a whole host of other conditions.

Folks, I can’t stress the risks of unresolved Medicare Conditional Payments enough.

CMS is making their message clear. They are looking for lawyers who aren’t protecting the Medicare Public Trust Fund and making examples out of them. I encourage you to learn more about this case in the video below, and shoot me an email with any questions that come out of it.

Within the press release that I reference above is one very important quote from United States Attorney William M. McSwain. In fact, it’s one that every trial attorney serving injury victims needs to be aware of.

Here is a link to that DOJ Press release so you can read it for yourself: https://www.justice.gov/usao-edpa/pr/philadelphia-based-personal-injury-law-firm-agrees-resolve-allegations-unpaid-medicare

Don’t be the next attorney or firm to take a hit from Medicare! Take the target off of you and your firm’s back by outsourcing these Medicare Conditional Payment matters to professionals who deal with liens day in and day out.

Give us a call at 888-MSA-PLTF (888-672-7583) or send us an email at info@plaintiffsmsa.com.

I’ll see you again next week!

*If you have any topics, cases, stories, or questions that you’d like me to cover in an upcoming video, shoot us an email at: info@plaintiffsmsa.com. We’d be happy to review it for a possible upcoming topic.

Jack Meligan, RSP, MSCC, CMSP-F

The Plaintiff’s MSA & Lien Solution

The Truth About Medicare Set-Aside Solutions – How What You Don’t Know Could Hurt You

Medicare eligible. It seems that when a defendant hears these words, CMS automatically places a target on your client’s back and aims for the bullseye. We have seen this happen year in and year out. That is why we crafted the ability to provide attorneys with holistic Medicare Set-Aside solutions.

The label of being “medicare eligible” can lead to many un-truths. For example, defendants may claim that your client must create an MSA. Un-true. And this one: that defendants won’t be able to settle your case until they have proof that Centers for Medicare and Medicaid Services (CMS) has approved your client’s MSA. Un-true. Or, that you must obtain a CMS letter stating that an MSA is not required in your client’s case. Un-true, and not even possible. If any of this sounds familiar, it’s because defendants have been telling you un-truths about Medicare Set-Aside (MSA) arrangements for years.

The truth is that there is no legal requirement for MSAs at all in liability personal injury cases. CMS is not approving liability MSAs. Also, CMS will not provide a letter stating that an MSA is not required in a specific case. In fact, MSAs are entirely voluntary. A conclusion that arose again as a result of the Aranki vs. Burwell case. Yet, this outcome doesn’t mean that MSAs should be ignored. No. Far from it. That is why we have tirelessly sought to provide Medicare Set-Aside solutions that address these untruths to help your client make an informed decision. Part of making an informed decision is knowing the history of MSAs, and understanding why MSAs should not be ignored.

The History Behind Medicare Set-Aside Solutions

The Aranki vs. Burwell case evolved from a medical malpractice case that started in 2009 in Arizona. While a settlement had been reached, the defendants were still concerned about its finality due to the uncertainty of the MSA question. A lot was unknown about MSAs back then, and the defendants thought they would be liable without a court decision on its necessity. They demanded that the plaintiffs supply them with a letter from CMS stating whether or not the client was required to set up an MSA. With no immediate answer, the settlement was held up for three years. That is, until a federal judge issued a pronouncement.

The judge stated that no federal law or CMS regulation requires the creation of an MSA in a personal injury settlement. It gets better. This judge was also asked to rule on forcing CMS to issue a letter as to whether or not this client needs an MSA. The ultimate finding being that there’s no federal law that requires it [CMS to issue a letter], so the court doesn’t see any standing here to even comment. No MSA required meant case closed, and this decision has acted as the ruling going forward. Yet, recent events indicate that a change could be coming soon.

Recent Developments

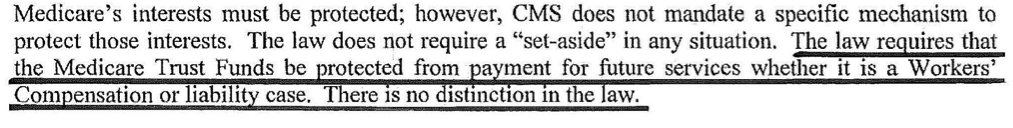

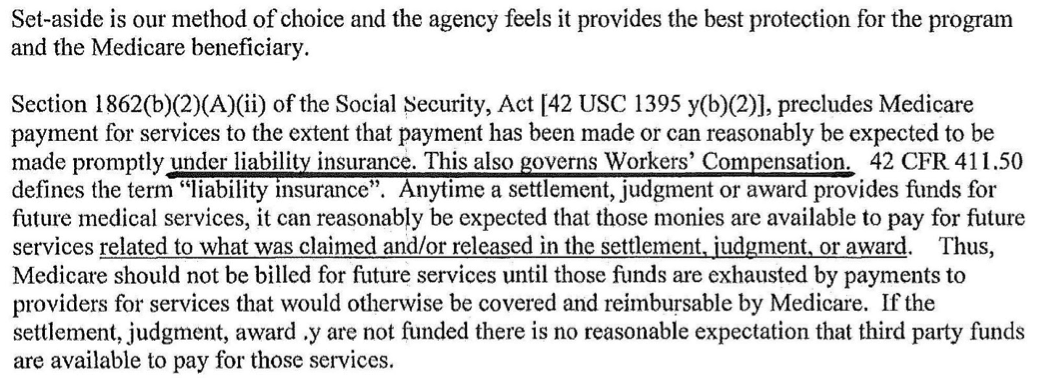

More critical insight is available in the 2011 Stalcup memo. A memo by Sally Stalcup, Regional Director of Region 6 for Medicare and CMS in Dallas. Her memo states that we must protect Medicare trust funds from payment for future service. Regardless of whether it’s Worker’s Comp. or liability. Surrounding language indicates that while CMS does not mandate a specific mechanism to protect those interests, and the law does not require a set-aside in any situation, that an MSA is the preferred method. Also of note is that any time plaintiffs can expect settlement funds to pay for future services, they can’t bill Medicare for future medical services until the exhaustion of these funds. Exact text is below:

After this memo, a clamor for guidance followed. With that, came an advance notice of proposed rulemaking. Issued on June 15, 2012. This advance notice, addressing liability cases, includes seven different options. All of them for handling the Liability Medicare Set-Aside issue. Especially alarming is option number four, below. It requires submitting a proposed MSA to CMS for review and approval.

Fast forward two years later to October 8, 2014. CMS withdrew The Project for Public Guidance. This advance notice was part of that project. Yet, expectations that CMS will resubmit at some point in the future still loom large. Added to these is another concern. Earlier, CMS published an update to a pre-solicitation for a workers compensation review contractor. It states that a Statement of Work (SOW) update will include the processing of Non-Group Health Plan (NGHP) Medicare Set-Aside arrangements. The anticipated award date? November 7, 2016.

All of these are signs that the U.S. Government has pivoted. Also, that they are looking once again at Medicare Set-Aside arrangements in liability personal injury cases.

What Comes Next?

Meanwhile, it’s important to decide whether, and which, Medicare Set-Aside solution is right for your client. That depends on their unique facts and circumstances. Also, whether they are a do-it-yourself or a do-it-for-you type. The law requires that we protect Medicare Trust Funds from payment for future services. That is true whether it is a Worker’s Compensation or Liability case. There is no distinction in the law. But how exactly will your client comply with the law? The old pick a number out of the air? Or a professional MSA Allocation Study? Then, next question, self-administer, or professionally administered? If they go the do-it-yourself route, can you trust that they will follow through and put some amount of money from their settlement in some sort of account? And then what, just decide on their own which Medicare bills should be paid?

If and/or when Medicare comes around and questions how your client determined the amount of their account, demanding a detailed accounting of how they spent that money, how will your client answer? What if Medicare dislikes their answers, and decides to deny future benefits for a time? Will your client still be happy with the advice you gave them today? Whatever you do, don’t make these decisions alone. Take advantage of consultation services from The PLAINTIFF’S MSA AND LIEN SOLUTION.

Let Us Help

Order our 3 Ways to Avoid an LMSA Toolkit. Together, we can decide if one of these ways can work for you. And if your client can’t avoid an MSA and wants professional help? Then we’ll create a custom, strategically-minimized Medicare Set-Aside allocation. One brought down to the lowest possible, reasonable and defensible number. The end result? More settlement funds in your client’s pocket. Less potential for future liability for you.

The PLAINTIFF’S MSA AND LIEN SOLUTION is here for you. Please visit our website at plaintiffsmsa.com or call us with any questions at 888-672-7583.

The best plaintiff’s MSA, is no MSA. We actually sell Medicare Set-Aside avoidance.

Two common questions asked during settlements are: “Is a Medicare Set-Aside Mandatory?” and “How Can I Avoid an MSA?“

The answers?

No, they are not mandatory.

…and…

We have a few ways where most of our clients can avoid an MSA altogether.

We’re different from all of our competitors because WE SELL Medicare Set-Aside avoidance.

Based on our records, two-thirds of plaintiffs can avoid an MSA. They can do it compliantly, without jeopardizing their future Medicare benefits, and without creating a long-tail liability for their trial lawyer.

I’ll stress it again. That’s what we sell at PMLS. MSA avoidance.

I can’t stress this enough because we truly want you and your client to avoid an MSA if possible. If it’s not possible in your case, we’ll reduce your client’s MSA to the lowest rock-bottom amount that is reasonable and defensible.

To help you get started, I want to give you our “Insider’s Guide to Avoiding MSAs” free of charge. You can get that by clicking the link right here right now: CLICK FOR FREE GUIDE

Within this, you’ll have the opportunity to download the “3 WAYS TO AVOID AN LMSA” toolkit as well.

After you check that out, give me a call at 888-MSA-PLTF (888-672-7583), with any questions or for a free consultation.

I’ll see you again next week!

*If you have any topics, cases, stories, or questions that you’d like Jack to cover in an upcoming video, shoot us an email at: info@plaintiffsmsa.com and we’d be happy to review for a possible upcoming topic.

Jack Meligan, RSP, MSCC, CMSP-F

The Plaintiff’s MSA & Lien Solution

Reducing an MSA from $1.6 Million to Zero – Another PMLS Victory

In this video, Jack Meligan gives you the background on an MSA reduced from $1.6 million to ZERO dollars.

THE INSIDER’S GUIDE TO AVOIDING MSAs

If you would like to receive a copy of THE INSIDER’S GUIDE TO AVOIDING MSAs – NO CHARGE go to www.AvoidingMSAs.com

3 WAYS TO AVOID AN LMSA Toolkit

To purchase the 3 WAYS TO AVOID AN LMSA Toolkit go to https://plaintiffsmsa.com/order-the-three-ways-to-avoid-an-lmsa-toolkit/

If you want more information about how THE PLAINTIFF’S MSA & LIEN SOLUTION can help you CONQUER your and possibly make them DISAPPEAR or get significantly reduced, then go to our PMLS website plaintiffsmsa.com. Or, call us at 888-MSA-PLTF (888-672-7583).

Also, check out our “Attorneys Sued Over Medicare Issues” resource here: www.AttorneysSuedOverMedicareIssues.com.

Three Ways to Avoid an LMSA (Liability Medicare Set-Aside)

Once again, we have innovated! Before, we had two ways that you could use to help your clients avoid an LMSA. Now, we have a third option for you!

888-MSA-PLTF (888-672-7583)

888-MSA-PLTF (888-672-7583)